Learning About Entrepreneurship at Intel ISEF 2013

Randa Flinn, a member of the Society for Science & the Public’s 2010 class of Society Fellows, attended the Intel International Science and Engineering Fair in Phoenix this May. Below are her thoughts on two of the symposium sessions she attended while at Intel ISEF.

Entrepreneurship, Business Models, and the Scalable Startup

So how does a science research or engineering idea become a marketable business? How can students become entrepreneurs? This workshop distilled a seven-week National Science Foundation Innovation Corp Lean LaunchPad Framework course into an interactive one-hour jam-packed session at Intel ISEF 2013!

Andre Marquis, from the Lester Center for Entrepreneurship at the University of California, Berkeley, energized a topic that could have been soporific! His charismatic questioning and clear framework and bullet points helped focus would-be entrepreneurs on key issues for successful start-ups. His background, having been a serial entrepreneur in the pharmaceutical industry and other sectors, has given him the scale and depth of experience needed to engage and advise.

Marquis involved participants by having them identify a customer segment (meaning the specific profiles of potential paying customers), naming two specific people that could be contacted about this idea, and testing the value propositions for a business plan.

Key points of entrepreneurship, according to Marquis, included:

- Identifying customer segments

- Describing value propositions

- Avoiding being deluded by your own passions

- Listening to your team and customers

- Interviewing 100 customers before going forward (best face to face!)

- Getting out of the building (get out of the office, away from the computer, and talk face to face to people)

Two suggested books extolled by Andre Marquis are The Start-Up Owner’s Manual by Steve Blank and Bob Dorf, and Innovator’s Dilemna by Clay Christensen.

The take away: failure means an opportunity to reevaluate and learn; talk to others; listen to others; get out of the building; clarify your customer segment; and be able to describe your value proposition.

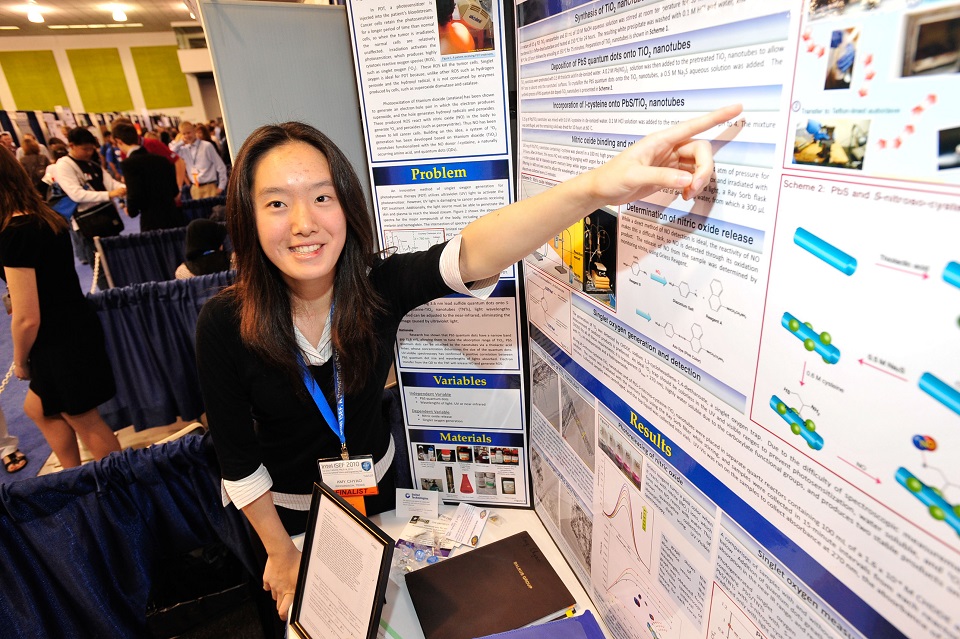

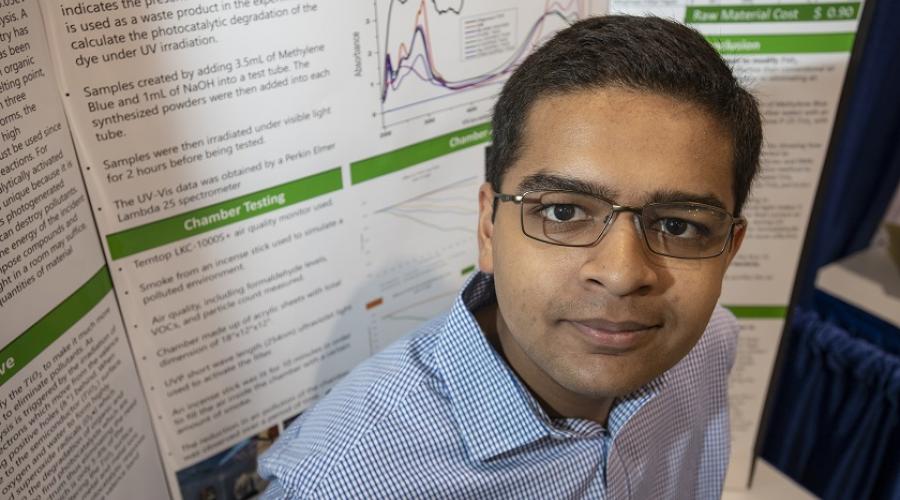

Innovator to Entrepreneur Panel Discussion

This panel of high-powered experts in the field of innovation and entrepreneurship gave the standing room only audience direct insight leveraged by years and broad ranges of experience. The panel was moderated by Wendy Hawkins, Intel Foundation Executive Director; an earthy, brilliant, approachable TED Talk presenter who clearly cares about her Foundation’s labor of love. The panelists included Harry Singh, Director of Intel Capital; Brian David Johnson, Futurist, Intel Corporation; Andre Marquis, Executive Director for the Lester Center for Entrepreneurship & Innovation at UC Berkeley; and Cindy Faatz, Director of Patents, Intel Corporation.

After introducing the panel, members began by answering audience questions concerning start-ups and entrepreneurship. The recurring theme to the earlier session was the value of failure. According to Marquis, failure followed by failure just brings one closer to success, while Hawkins interjected that at Intel, the advice for new entrepreneurs is to fail fast, and then identify the true problem. Johnson advised that failure means success because now you know what NOT to do!

Several questions regarding patents followed, and Faatz, Director of Patents at Intel, answered many of the questions. She clarified that patents are not required before marketing a product, but are suggested if looking for investors or if others could easily copy and take one’s idea to market. She also warned of the new rules concerning time-sensitivity of patents. Johnson discussed the teaching value of researching and applying for a patent, suggesting that the process of documentation and writing about iterations are excellent process skills for students to develop.

Additional questions were about venture capitalists: what are they, how do they differ from angel inventors, and how to find them? The short answer, provided by Singh, is that venture capitalists (VCs) are persons who partner with private firms (typically a venture capital firm or pension fund) and invest monies into a company that is starting up but that is too small to raise funds through the public sector. An angel investor is an affluent individual who invests his/her own personal funds into a start-up. Both VCs and angel investors invest in hopes of getting a return on their funds. He explained how uncommon it is for entrepreneurs (less than 50%) to become CEOs of their own start-ups.

A philosophical question ensued: why patent and what is appropriate to patent? Marquis answered this eloquently – If the patent helps diffuse innovation and spread ideas, then yes, patent! If getting a patent holds back innovation and the spread of ideas, then it is inappropriate to patent. Johnson weighed in with his fascination about patents and pointed to all the open source materials that are available patent-free in the 21st century. Faatz described the cost of patenting. Costs include search fees, filing fees, and application fees.

After the panelists answered questions for the audience, Wendy Hawkins directed the experts to station themselves at various areas in the room and gave the participants a chance to do “speed mentoring” sessions. This was undoubtedly a valuable time for those innovators with specific questions. In all, the session was extremely valuable to students with engineering projects or start-up ideas. When else does a teen have the chance to speak to the top dogs in one of America’s best companies?